XAU/USD Trading Guide: How to Trade Gold vs the US Dollar

Reading time: 9 minutes

Overview of Gold

Gold (ticker: XAU) is a widely popular precious metal with unique properties and a long and colourful history. It served as a medium of exchange and a store of value for centuries.

Its rare colour, beauty and durability, conductivity, chemical stability, and resistance to corrosion have allowed the metal to be used in various applications. As you will be aware, Gold remains a popular choice for jewellery – used to symbolise a position of wealth in many cultures – and across industrial applications, such as electronics and medical devices.

Gold is also one of the most popular investment products among institutional investors and independent retail traders. Known for its volatility and long-term trends, it is commonly traded versus the US dollar (USD), the Australian dollar (AUD), and the euro (EUR). Investors can gain exposure to Gold in various ways, including physical ownership, leveraged derivative instruments such as Contracts for Difference (CFDs), futures and options, and investing in Exchange-Traded Funds (ETFs) as well as through mining stocks.

How Do CFDs on Gold Work?

CFDs, or ‘Contracts for Differences’, work the same irrespective of whether an investor trades Gold, Silver or Oil. The core structure of a CFD contract involves two parties: one who assumes a long position (buy) and another who executes a short position (sell). Unlike buying and selling physical Gold, which may involve storage costs, Gold CFDs can be traded (and used for hedging) around the clock, five days a week, without taking physical ownership of the underlying commodity due to their derivative nature – Gold CFDs are not physically deliverable; they are always cash-settled.

In addition to the ease with which CFDs permit investors to trade rising and falling markets, the ability to trade with leverage is a key attribute of the CFD market. With FP Markets, you can trade the underlying price movement of Gold with a 5% margin, allowing investors to increase exposure greater than their account equity.

Step-By-Step Guide on How to Trade Gold CFDs with FP Markets

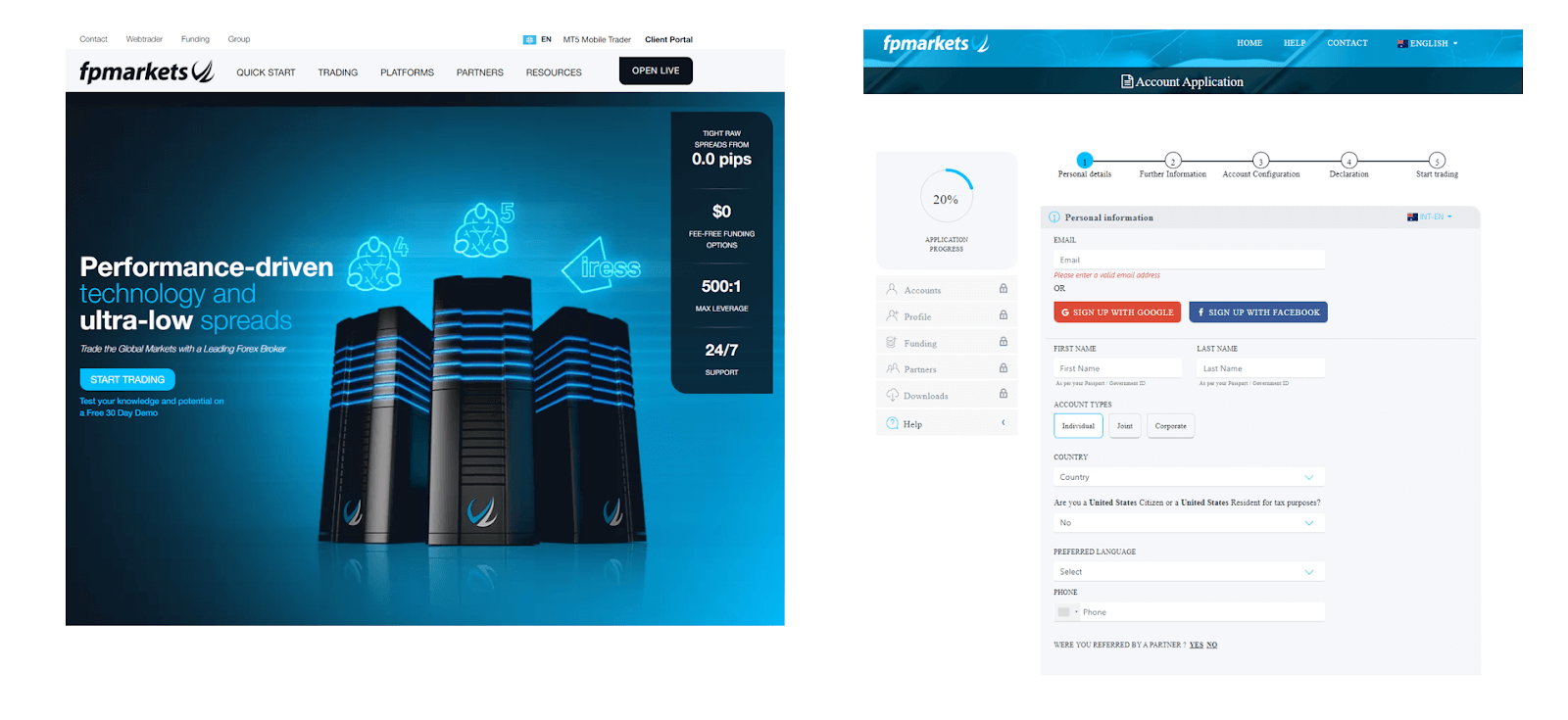

1. Open an FP Markets Forex and CFD Trading Account

Opening a trading account with FP Markets is the first step to investing in Gold. You can do this by visiting the FP Markets homepage, clicking the OPEN LIVE tab, and filling out the five-step Account Application.

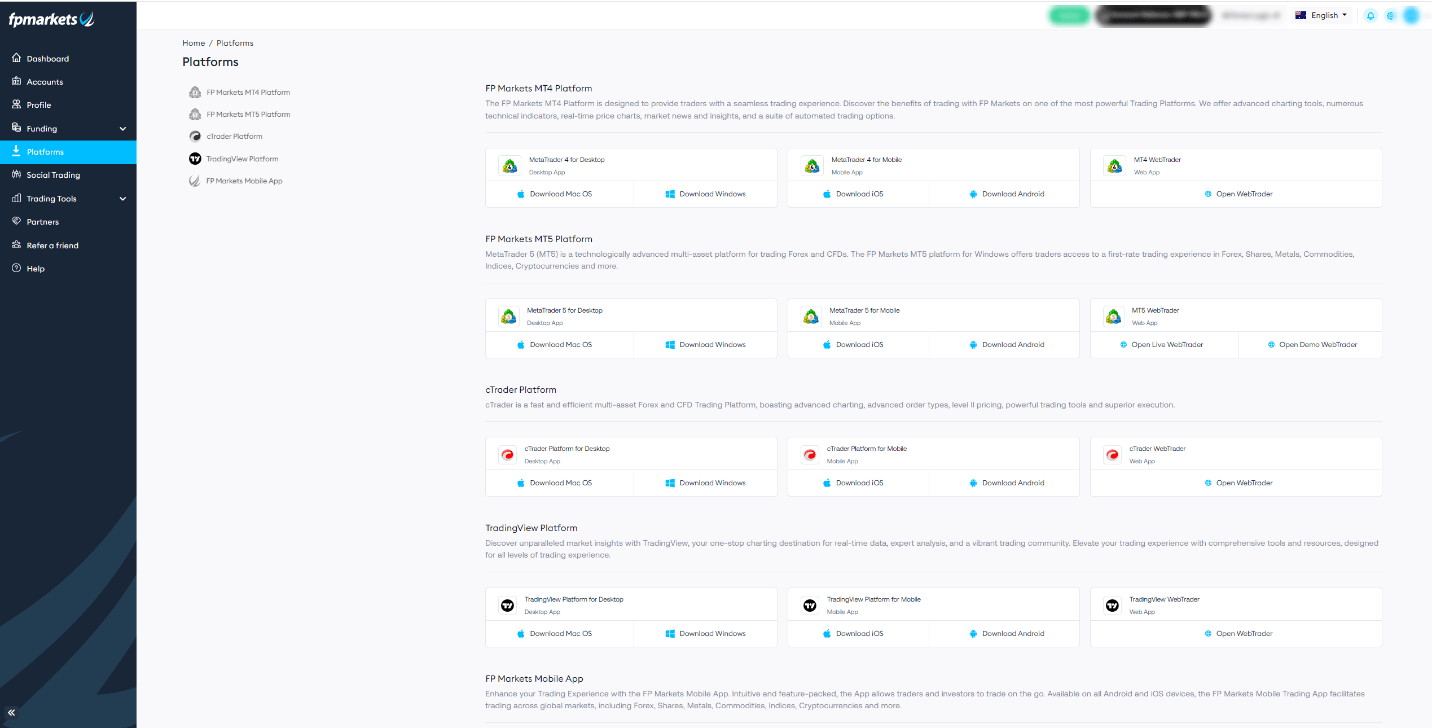

2. Download your Trading Platform

Trading platforms are essential for successful investing. Selecting and downloading your preferred trading platform with FP Markets can be done through the Client Portal, which is accessible using the login credentials created when registering.

Gold can be traded using many different trading platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView.

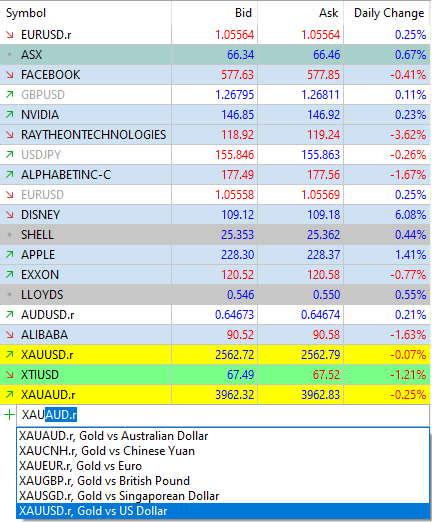

3. Find the XAU Ticker

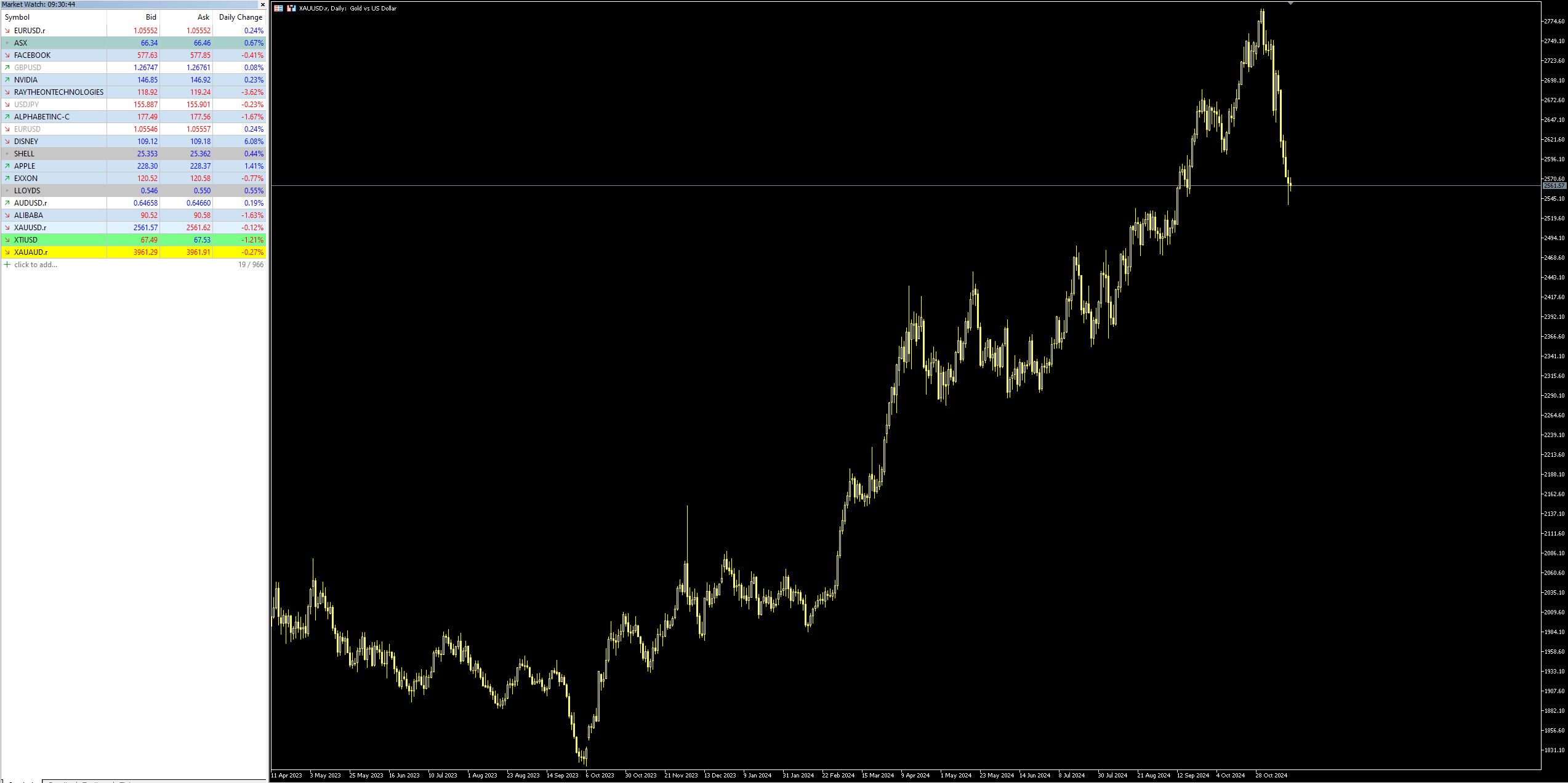

Finding the XAU ticker on either MT4 or MT5 is similar and begins with the platform’s Market Watch (Ctrl+M). Using the MT5 platform, you can enter ‘XAU’ in the ‘click to add’ function at the bottom of the Market Watch and select ‘XAUUSD’ (shown in the first image below). This forms a new row within the Market Watch, from which you can then drag and drop the instrument to the chart’s main interface (shown in the second image below).

4. Place the Buy or Sell Order

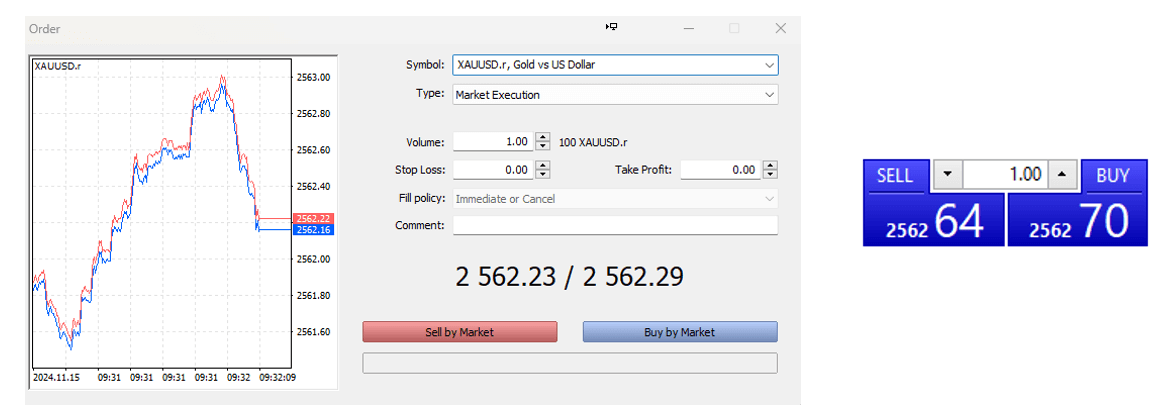

A handful of options are available to place buy and sell orders within MT4 and MT5. Below is the one-click trading feature (Alt+T – image on the right), which, as its name suggests, allows traders and investors to enter a buy or sell order with ‘one-click’ once the trading volume has been set. However, most market participants opt for the platform’s order window (F9 – image located on the left), which permits the entry of stop-loss and take-profit orders; these are crucial risk management tools.

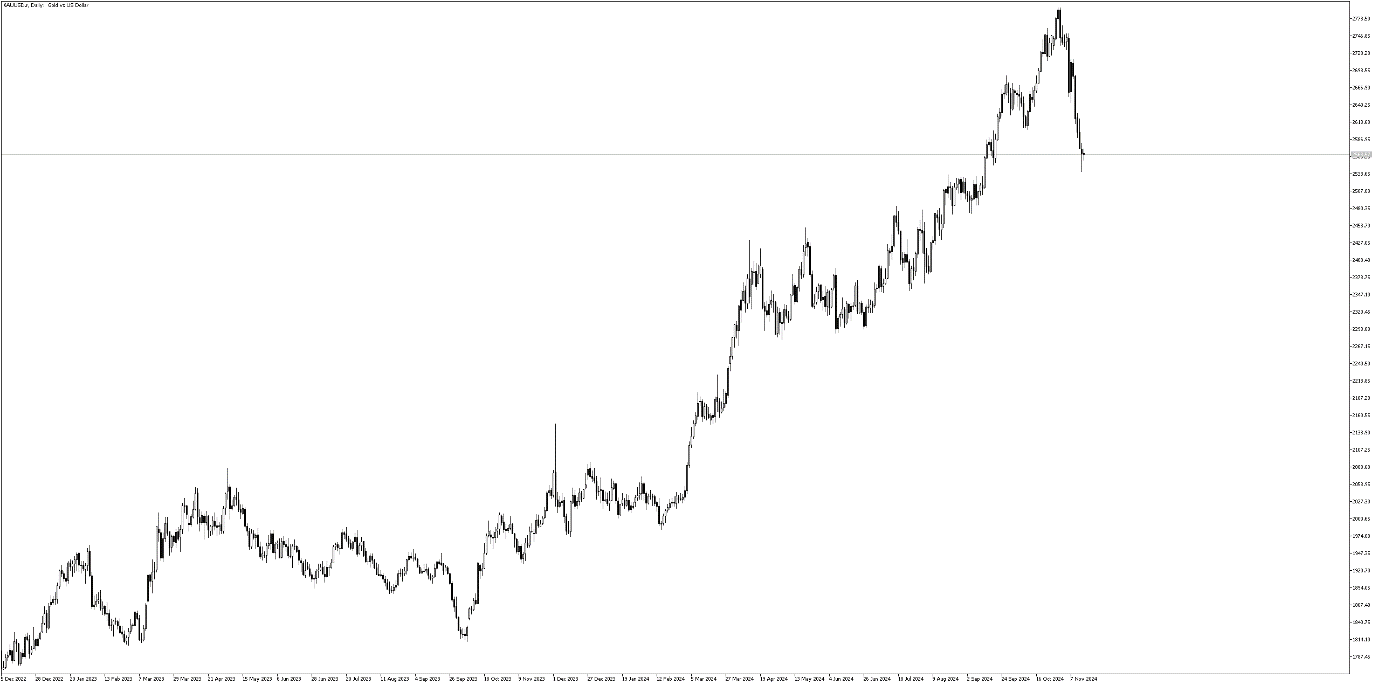

Gold (XAU/USD) Price Chart

Should I Invest in Gold?

According to data from Refinitiv, the mean (median) price target for Q4 24 is US$2,621 (US$2,630). Interestingly, the highest forecast over this period is US$2,900, with the lowest estimate at US$2,315.

Despite the value of Gold pushing higher for much of this year and reaching a record high of US$2,790 late last month, November has seen the price of Gold drop nearly 7% so far. The depreciation in Gold’s price is partly due to the recent surge in the USD, aided by the market expecting fewer rate cuts in the face of stubborn inflation and investors continuing to assess the implications of Donald Trump’s presidential election win.

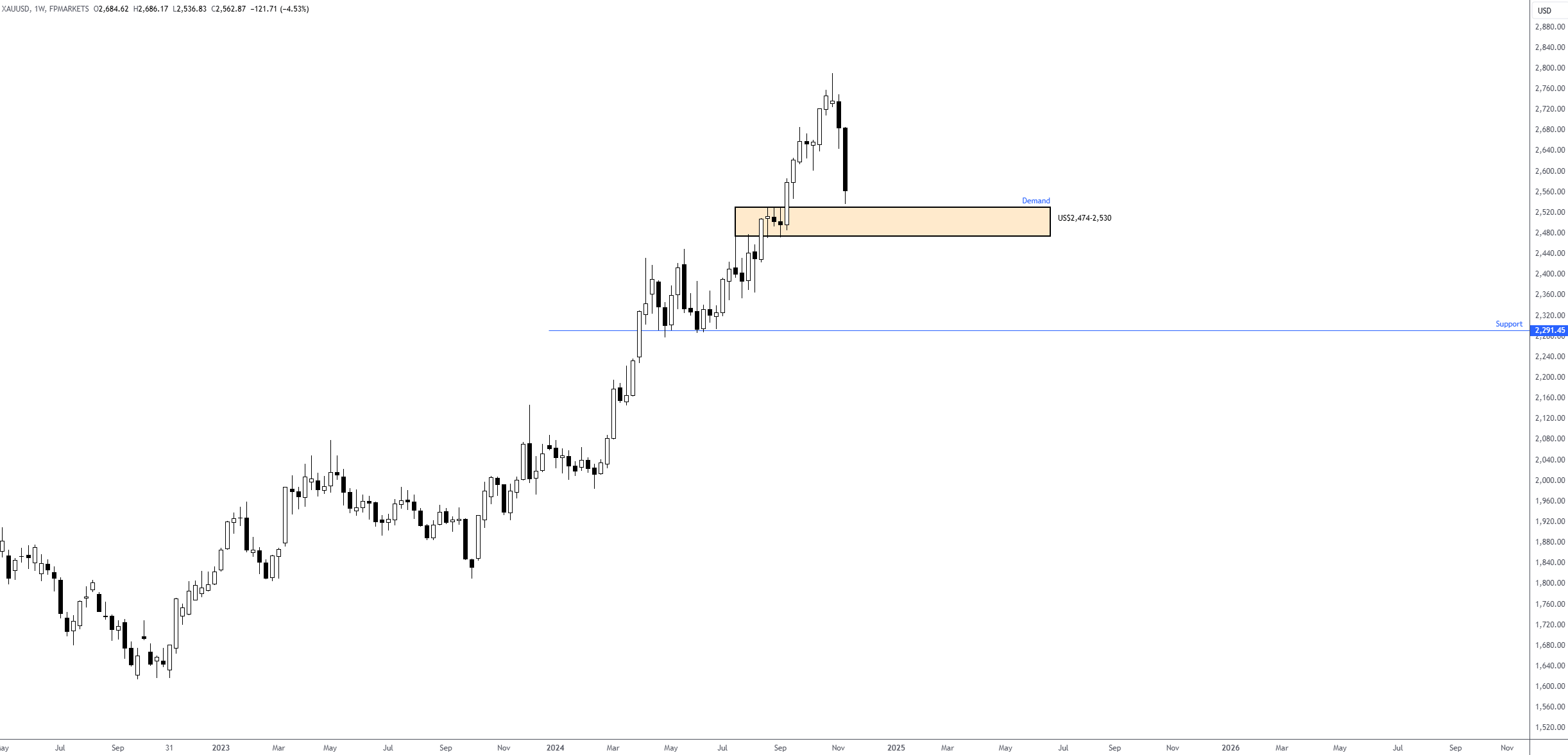

With the ongoing ‘Trump Trade’, technical analysis suggests Gold will unlikely find much support until the current ‘market euphoria’ wanes. However, the FP Markets Research Team recently underscored a potential demand area on the weekly timeframe between US$2,474 and US$2,530 (see chart below), which could offer longer-term investors a platform to consider buying into the recent dip. Time will tell if buyers respond to the area, but should the precious metal push lower, this could be bad news as the next obvious support level is not seen until US$2,291.

Other reasons investors often choose Gold as an investment include wealth preservation, particularly in times of economic uncertainty, and to help with portfolio diversification.

Alternative Investment Options?

- Physical Shares

In addition to Gold CFDs, physical shares of Gold mining companies are an option for some investors to indirectly invest in Gold. Despite Gold mining companies often sharing a strong correlation with the price movement of Gold, you must take into account that several factors determine an individual company's performance, such as revenue and bottom line, in addition to geopolitical events, economic indicators, and market sentiment.

Also important to understand is that by investing in a company and becoming a partial owner proportionate to the number of shares purchased, you may be entitled to dividend payments and voting rights at the company’s annual meeting.

- Futures and Options

Another way of investing in the price movement of Gold is through the futures or options derivatives markets.

Both futures and options contracts are legalised standardised agreements that specify aspects such as the quantity and quality of Gold, the date for delivery (futures and options on Gold can usually be psychically delivered, but investors often choose cash-settled transactions before the expiration date), as well as the price at which the Gold will be bought and sold, etc.

The primary difference between a futures and options contract is the obligation. In a futures contract, both parties must fulfil their side of the contract: the buyers must buy, and the seller must sell at the specified price and date. In an options contract, nevertheless, the option buyer has the right but not the obligation to buy or sell Gold at a specified price (strike price) within a specific timeframe. It is the seller (the writer) who must fulfil the contract if the contract buyer decides to exercise their right. This usually occurs if the option contract trades ‘in the money’ (ITM).

- Exchange-Traded Funds (ETFs)

An alternative way of investing in Gold is through ETFs, which offer a convenient and cost-efficient way to invest in Gold. ETF funds trade on stock exchanges and can be traded just like a regular stock with a unique ticker symbol that tracks the price of Gold, with some ETFs being physically backed (fund holds physical bullion) and others synthetically backed (using derivatives).

Providing a liquid and affordable way of investing in Gold, a Gold ETF can help diversify one’s portfolio. Popular Gold ETFs include SPDR Gold Shares (GLD), which can be traded with FP Markets via CFDs.

FAQs:

1. What are the major differences between CFDs and physical shares?

CFDs and physical shares are similar in many ways, yet where they’re traded, ownership rights and the leverage available are where they differentiate. For example, CFDs are traded in the over-the-counter market (often called the OTC market). They are derivative products whereby CFD investors do not take ownership of any underlying asset, and trades are always cash-settled. In contrast, physical shares are traded on a formal stock exchange (and bestow ownership rights). CFDs and physical shares can be traded with leverage, yet the latter offers greater flexibility regarding higher-leverage options.

2. Can I trade Gold on MT5?

With FP Markets, Gold can be traded on MT4, MT5, and cTrader.

3. What are the trading hours for Gold?

The trading hours for Gold are between 01:01 and 23:59 GMT+2 (Monday-Friday).