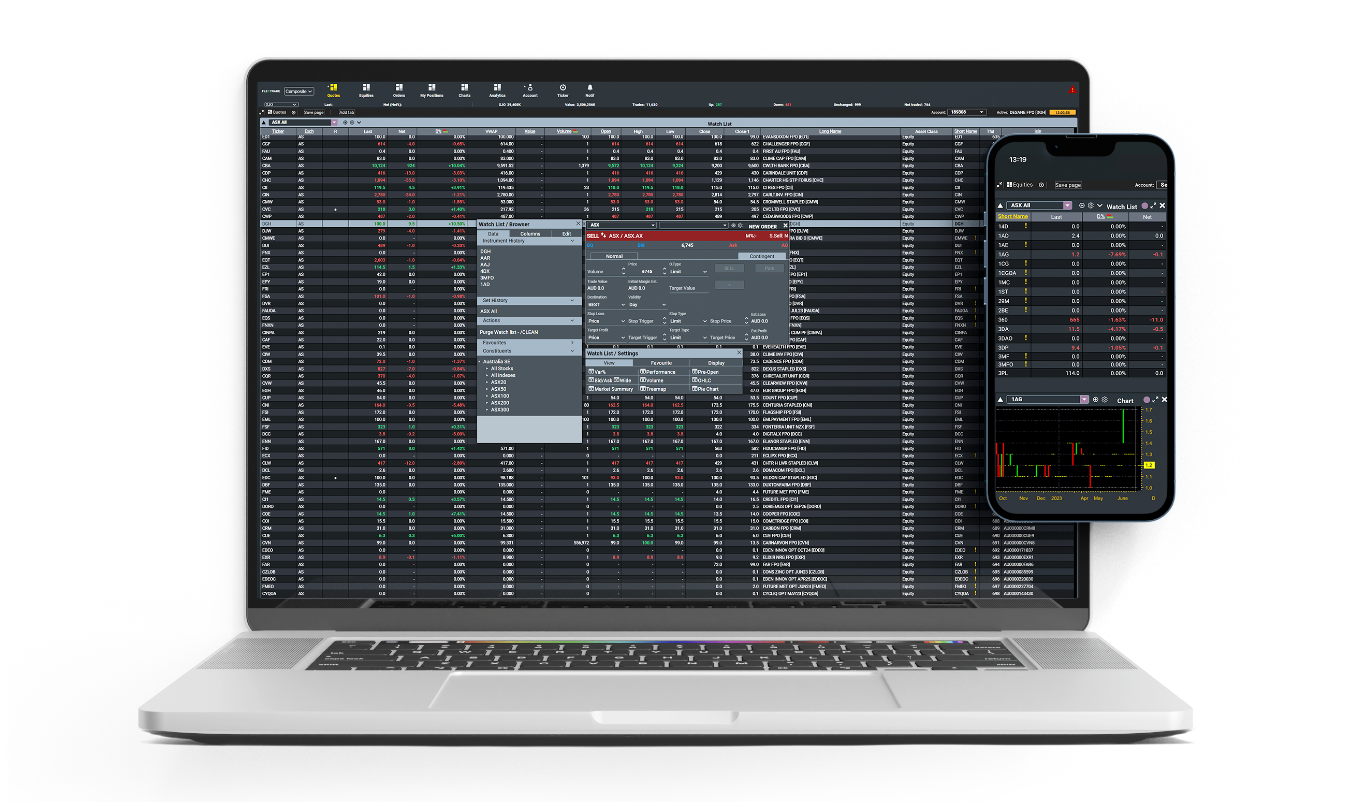

What is the Mottai Platform?

Combining a blend of institutional technology expertise from Flextrade with FP Markets’ long history of supporting Retail Clients, the Mottai Platform offers ASX Traders a Low Latency, responsive Platform with a clear focus on rapid-order entry features. Mottai delivers a robust trading solution designed for sophisticated traders who demand more from their trading tools. FP Markets Kenya merges the Mottai Trading Platform with the powerful DMA CFD Trading Model to deliver superior trading solutions.